Top up health plans: Are they worth the buck?

What is the size of your health cover? Rs 2 lakhs, Rs 3 lakhs or Rs 5 lakh? This sum assured as it is called in insurance parlance could cover for minor hospitalisation costs. However, life threatening ailments such heart surgery and cancer come with a heavy price tag and your health insurance may really fall short of medical expenses.

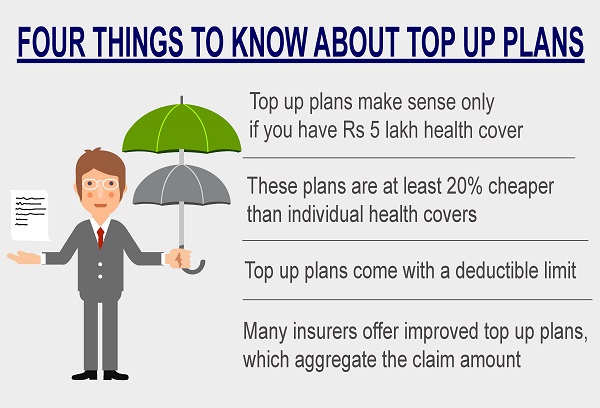

With medical inflation growing in double digit, year after year, it is inevitable that hospitalisation expenses are also on the rise. In such an event, your health cover could fall short of medical expenses and burn a hole in your pocket. Hence there is a need to review your health insurance and cover any short fall. In such a scenario it makes sense to go for a top up plans as they are at least 20% cheaper than going for a new health cover altogether.

What is a top up plan?

It is a regular indemnity plan that covers hospitalization costs only after a certain threshold limit, which is called a deductible in insurance parlance. One portion of the claim is borne either by the policyholder or the other insurer. Once the policyholder pays off that component, the top up health cover kicks in.

Let’s assume you have taken a top-up plan of Rs 10 lakhs and it has a deductible limit of Rs 4 lakhs. If the total hospital bill comes to Rs 7 lakhs, you need to pay Rs 4 lakhs and the balance (Rs 3 lakhs) is paid from the top up plan.

Why are top up plans cheaper?

No there are no caveats here. These plans are at least 20% cheaper than individual health covers mainly on account of deductibles. These deductibles protect top up plans from frequent claims. Hence the insurers are able to keep the pricing of such plans lower.

When does it make sense to opt for a top up plan?

Given the spiraling medical costs, a basic health cover of Rs 3 lakh to 5 lakh health cover is not enough. A top-up plan is definitely a good way to bridge this shortfall. However, it’s not the best option always

- If your base cover is high say Rs 5 lakh or more, it makes sense to opt for a top up plan

- If your base cover is low say Rs 3 lakhs or less, it’s better to opt for another individual health plan since top up plans are mostly reimbursement plans

Top up plans: What’s available in the market?

There are two kinds of top-up plans available: basic top-up plan and a floater plan.

Basic top up plan:

The policyholder will get the benefit of a top up plans only if the bill exceeds the deductible limit in single event of hospitalisation. For instance, if an individual’s hospitalization bill is Rs.5 lakh and the top-up plan has Rs.3 lakh deductible and the individual gets hospitalised twice in the year, the first time it costs Rs.2.5 lakh and the second time Rs.2 lakh, the top-up plan will not get triggered at all. The total bill overshoots the limit of Rs.3 lakh, however, each event of hospitalisation is well within the deductible limit.

Floater plan:

With a floater plan where two members get hospitalized with bills of Rs.2.5 lakh each, the top-up plan will not get triggered at all. Even though the total amount is more than Rs.3 lakh, individually they are within the deductible limit.

Aggregate claim:

This is an improvised version of the above mentioned plans. This plan puts together several cases of hospitalization to calculate the deductible limit. So if the total bill of all the events of hospitalisation crosses the deductible limit, the top up plan will get activated.