No Cash, No Problem! Use these electronic payment methods

Government’s intention to destroy black money has led the common men into trouble. India is normally a cash favored country and the daily transactions are mainly based on the cash payments. Government couldn’t keep its promise of bringing the situation to normal in fifty days as people are still allowed to withdraw limited cash from their bank accounts. In this moment when cash is not available freely, the electronic transactions are the only way to continue the small and large payments. Apart from being easy and hassle free, the electronic payments are more transparent. Hence, the government is encouraging to develop a cashless society.

Let’s check out some of these online methods of transaction through the electric payment system,

Net banking

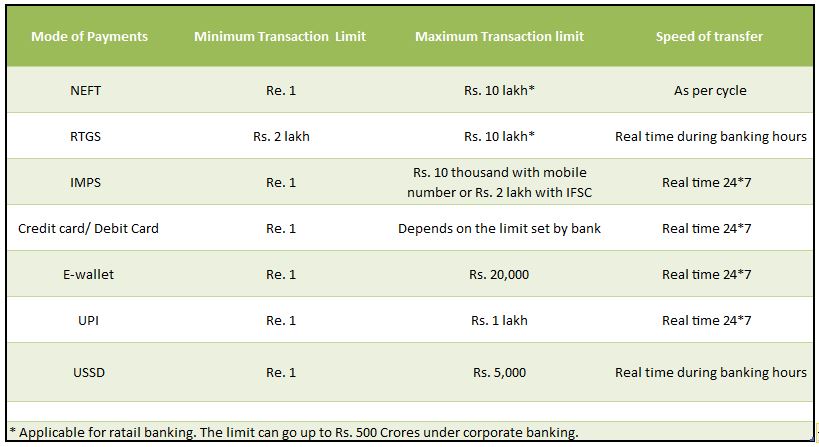

Internet banking or online banking allows the customer to avail most of banking services from the comfort of home or office. Apart from transferring fund from one account to another account customers can also pay government taxes, school fees or utility bills etc. Internet banking is also famous in the segment of online shopping. To access internet banking facilities the customer needs to login to the website of the particular bank. The fund transfer system of Internet banking can vary according to the need of customer. If a person is sending the money to somebody who has an account in the same bank, then the transaction falls under the category of the direct payment in the same bank. The electronic bill payments and funds transfers are relatively easy in the case of same bank transfer. The customer can also opt for electronic bill payments and funds transfers in the account of the other bank. The intra-bank fund transfers vary due to the mode of payments. The RTGS, NEFT, and IMPS are various methods of the intra-bank fund transfer.

The IMPS or Immediate Payment Service is a fund transfer facility that allows account holders of the bank to transfer money from one bank to another account on real time bases. The service is available all 365 days including Sundays and public holidays. The maximum limit of fund transfer is Rs. 2 Lakhs with IFSC or else up to Rs. 10000 can be transferred using Mobile Money Identifier (MMID).

The NEFT or National Electronic Fund Transfer is another facility to transfer fund from account in one bank to another account in a different bank. Unlike IMPS or RTGS fund is transferred in batches. Transactions take place 11-12 times a day between 8 am to 7 pm on all working days. The service is not available on Sunday and public holiday. Any amount between Re. 1 to Rs. 10 lakh can be transferred through NEFT. The limit can go up to Rs. 500 Crores under corporate banking.

The RTGS or Real Time Gross Settlement, on the other hand, is a service to transfer funds in real time. It is normally meant for the transfers of the large amount, the minimum amount of transfer needs to be Rs. 2 Lakh. Upper limit of fund transfer is Rs. 10 lakh from saving accounts but it can go up to Rs. 500 Crores under corporate banking.

Credit card/ Debit Card

The credit or debit card is another vital method of electronic fund transfer. The debit cards are linked to the bank account directly so the money spent through debit card gets debited from the bank account immediately. The debit card can be used at merchant outlet or online for buying goods or services. Like debit cards, credit cards can also be used for all financial transactions but it work on the principal of ‘buy now pay later’. Credit card holders generally get a free credit period of 40 to 50 days form the billing cycle after which interest is charged on the outstanding amount.

E-wallet

E-wallet or Mobile wallet is an online prepaid account that stores the required amount of money in a digital form, which can then be used as and when required. Basically it allows you to store multiple credit cards and bank account numbers into one exhaustive account, thus eliminating the need to enter such information each time a transaction is made. Using an e-wallet, you can make purchases or even transfer funds to others with the help of its integrated software system. In other words, e-wallets holds pre-loaded online money, similar to the physical wallet that carries the actual currency for you. Paytm, Mobikwik, Oxigen wallets, Freecharge, SBI Buddy and ICICI Pocket are some of the popular E-wallets available in India. The daily transaction limit is Rs. 20,000 till December 30, 2016 as per RBI guidelines.

Unified Payment Interface

A Unified Payment Interface, UPI is a mobile application that has linked several banks. The application enables payment transfers between any two banks simply using a smartphone. The application can be used to make payments from an individual’s bank account to numerous merchants without any requirement of typing your bank details for every transaction made. It can be operated 24*7 on all the 365 days. The app permits people to make bill payments, over the counter payments, as well as use the barcode scan and pay payment method. However, the transfer limit for every transaction is 1 lakh.

Unstructured Supplementary Service Data

The Unstructured Supplementary Service Data or USSD is a global system for GSM based mobile communication technology. Account holders can avail the service from their mobile phone without internet. Account holders can check the balance of their account, transfer fund and get mini statement immediately on their phone.

Aadhaar Enabled Payment System

Aadhaar Enabled Payment System (AEPS) offers banking facility through Micro ATMs. Account holder’s credentials are authenticated using Aadhaar number and the service is available on anytime-anywhere bases. Customers can avail basic banking facility like checking account balance, deposit or withdraw cash and transfer money from their Aadhaar- linked bank accounts to other bank accounts.