LIC’s New Money back policy 20 years – Review

LIC’s New Money back policy is a traditional plan that participates in profits of company. Policyholder will be entitled to receive simple reversionary bonuses declared as per the experience of the insurer, provided the policy is in full force. Lets look at a few key features and benefits of this policy.

● Policy duration 20 years with premium paying term of 15 years

● Sum assured is higher of 125% of basic sum assured or 10 times the annualized premium

● 20% of Basic Sum assured paid at the end of 5th, 10th and 15th year and 40% at the time maturity along with accrued bonus ( if any)

● Accidental Death and Disability rider is available with this policy.

● Premium paid towards Life insurance policy is allowed as deduction within the limit of Rs. 1.50 lakh under section 80C of income tax act.within the limit as per the prevailing tax laws.

Death Benefit may not be sufficient

The life cover of 10 times the annual premium is very less compared to what’s available currently in online term plans. If a 30 year old non smoking male wants to take an insurance cover on 25 lakh with LIC’s money back policy he will have to pay an annual premium of whooping Rs 1,86,295 or Rs 15,854 per month. Where as he can get the same insurance coverage for as little as Rs 3475 per year or Rs 290 per month as my LIC’s very own e-term Plan. In reality very few people will be able to afford the premium required to adequately cover their life risk by purchasing LIC’s money back policy. As a result in the event of an unfortunate incident their loved ones will be left vulnerable. If you plan to buy LIC money back policy for your life insurance needs then this policy is definately not for you.

Policy term may not be adequate.

LIC’s Money back policy is for a fixed tenure on 20 years. Life assured especially the younger ones may be left without adequate insurance coverage at the expiry of the policy term. One may find it difficult to buy fresh life insurance policy after the policy term due to advanced age. Even if its possible to buy a new life insurance policy at that age the policyholder will have to pay a much higher premium. For example, premium of LIC e-Term plan for sum assured of Rs. 25 lakhs comes to Rs. 16,825, if a 50 years old wants to buy a policy for 20 years term but a 30 year old will pay only Rs. 3,475 for the same policy.

Rate of return may disappointment you

LIC’s 20 year money back policy promises periodical returns to the extent of 20% of the sum assured as a survival benefit at the end of 5th, 10th and 15th year and 40% at the end of policy along with bonuses ( if any).

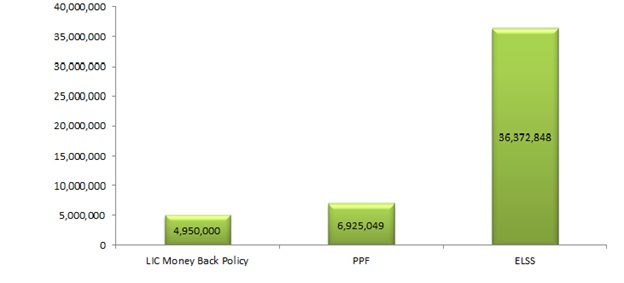

Lets do a quick analysis to understand what happens in an individual buys a term insurance policy like LIC’s e-Term plan for a sum assured of Rs 25 lac and invest the remaining amount that he would have otherwise paid as premium for the money back policy. In case the investment is made in Public Provident Fund(PPF) the total return at the end of twenty years is expected to be Rs 69.5 lakh, if current interest rate remains same in future. If the investment is made is tax saving mutual fund (ELSS) the expected return is a whopping Rs 3.6 crores, considering the historical returns. This is more than 7 times the return of the LIC’s Money Back policy and that too after paying premium for life insurance coverage.

Conclusion

One often fails to realise the impact of time and inflation when calculating returns. Rs 34.5 lakh that the Money back policy is expected to return at the end of the term of 20 years is barely worth Rs11 lakh in today money term considering a moderate inflation rate of 6%.LIC’s New Money back policies neither provide adequate life cover nor does it provide reasonable return on the money invested. Infact, Its returns are lower than the prevailing rate of inflation meaning the only guarantee it provides is the guarantee that you will lose value of money.

Assumption :

● Long term inflation is taken at 6%

● Simple reversionary bonus has been assumed at Rs 39 per 1000 sum assured

● Final Additional Bonus has been assumed as Rs 200 per 1000 sum assured

● PPF return has been assumed at 8.7% per year.

● 10 year average return of 20.41% has been assumed for ELSS mutual fund as per AMFI Diversified Equity Fund Performance dated September 2014