Investor should avail ASBA facility to invest in IPO

In the traditional method when an investor submits an IPO application, it is has to be supported by a cheque. If shares, NCDs or Bonds are not allotted or allotted less than the quantity the investor applied for, the balance amount is refunded to the investor. Refunds are directly credited by IPO registrar to the investor’s Bank account linked to his Demat account on the date of allotment, provided the MICR number of the investor’s bank account is updated in his demat account, failing which he shall receive the refunds vide physical warrant sent through POST/ Courier by IPO registrar. Delay in refund is a common complaint, what investors often have in such case. The delay could be on account of postal delay or incorrect address in demat account records of the investor.

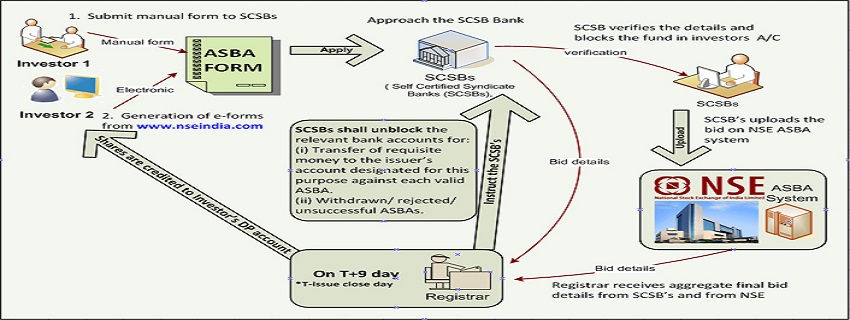

To address the issue of delay in refund and such other issues, the Securities and Exchange Board of India (Sebi) introduced the concept of Application Supported by Blocked Amount (ASBA). ASBA is a supplementary process of applying in Initial Public Offers (IPO) and Follow-On Public Offers (FPO) made through Book Building route and co-exists with the current process of usinga cheque as a mode of payment and submitting applications. The traditional process would require the investor to invest the entire application money, depending upon the number of shares subscribed, at the time of subscribing the issue.

ASBA is a facility to protect the interest of retail investors. It requires an authorization from the applicant to the bank, to block the application amount in his bank account, required for subscribing an issue. If an investor is applying through ASBA, the applicant’s bank account will be debited only if he has been allotted the shares. The amount debited will be according to the number of share allotted.

Almost all the banks today provide this facility. Though it’s a powerful and convenient feature, its process too is very simple. One needs to submit the Beneficiary Registration form available at banks. This can be done over Net Banking too. In case of registration through net banking it further requires a Beneficiary Activation process. Once activation is done, you can apply for IPO or FPO through Net Banking or Phone Banking. You can also subscribe by submitting an ASBA application form, which is a separate form, available at the banks. All you need is savings account or current account with bank and PAN. A Demat account is also required which is compulsory otherwise also.

There are several benefits of ASBA over the traditional method.

No Interest Loss: Since the application amount is just blocked and not debited from the account, till the time shares are allotted, the amount will be considered for interest calculation.

Average Quarterly Balance (AQB): Since the amount is available in the account, although you cannot withdraw, it will be considered for the calculation of Average Quarterly Balance, which is not the case in the traditional process. Hence you need not to worry for the penalty for not maintaining the Average Quarterly Balance.

Easy Refund: The amount for which the shares have not been allotted is available immediately on completion of allotment process. There is no need toworry about loss or delay of refund cheque which was the case earlier. It saves botheration and also the interest.

Modification/Cancellation:The bids can be revised (upward or downwards), withdrawn or cancelled during the issue open period. The investor just needs to intimate the bank where he has the ASBA facility, only during the bidding period, and the amount will be unblocked immediately. In case of withdrawal post the closure of bid, the Bank on receipt of information from the Registrar shall unblock the amount.

Multiple Applications: Multiple applications by a single investor are not allowed, however an investor can make 5 applications from a single account in the name of different persons.

Less Time Consuming: As an IPO can be listed only when all the refunds have been made, ASBA has shortened the time period of IPO’s from issue to launch.

ASBA is a simple, fast and convenient way of subscribing to IPO and FPO.