HDFC Cick2invest – Is it really worth investing?

Ulips are known for it’s high cost structure but fortunately not this time. After the bitter experience investors had with ULIPs, Click2Invest gives a new ray of hope.HDFC Life launched another Unit Linked Insurance Plan Click2Invest, a couple of months ago and now marketing it aggressively through TV commercials and Newspaper advertisements. To offer a lower cost structure the policy is available to buy exclusively online through internet. Charges are undoubtedly low in the plan but is it still an ideal investment product. There are some serious shortcomings in combining insurance and investment. Click2Invest is not an exception.

What is good about it

Unlike other ULIPs, HDFC Click2Invest is truly a low cost policy. There are no other charges except mortality and fund management. Sum assured is available to the extend of 10 times the annual premium and investor get choice of eight funds to choose from.

Why should you avoid it

Fund Performance

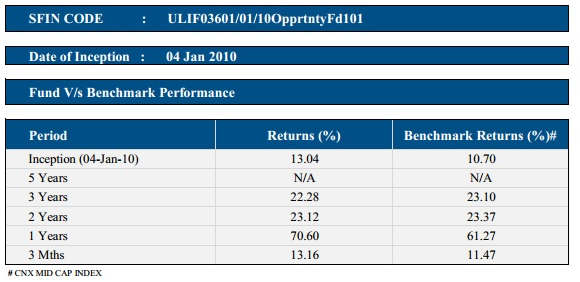

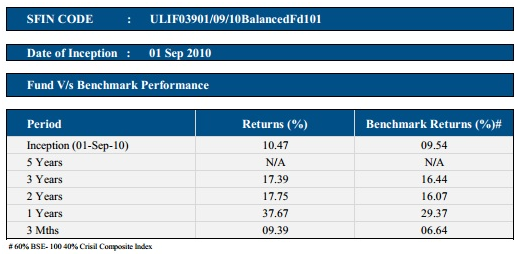

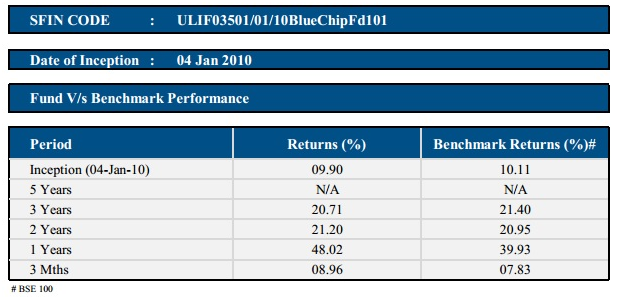

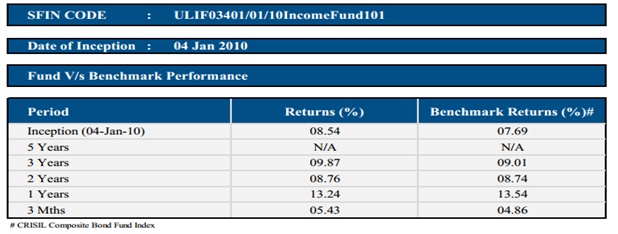

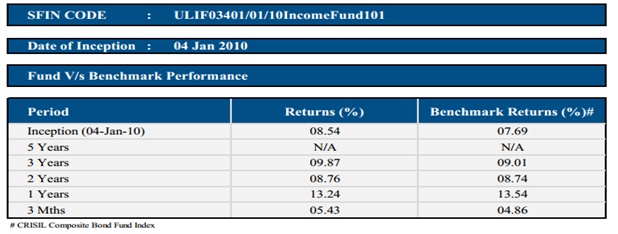

Of the eight funds available for subscription four have been launched within the last 6 months. So any meaningful long term performance comparison is currently not possible .The remaining four viz. Income fund, Opportunity fund, Bluechip fund and Balanced fund were launched during 2010 and have struggled to beat the performance of their respective benchmarks. The best performer among them is the opportunity fund which beat the benchmark by 2.3% while the worst performing is the Bluechip fund with returns below the benchmark.

Inadequate Death Benefit

If an individual wants to cover his life with Click2Invest he will be thoroughly disappointed. Sum Assured is just 10 times the annual premium compared to 881 times for an online term policy like HDFC Life’s very own Click2Protect Plus. For instance, if a 30 year old non smoking male wants life insurance coverage of Rs 25 lakh, he needs to pay a premium of whopping Rs. 2.5 lakh per year for Click2Invest. The same sum assured can be bought for as little as Rs 2,837 per year with Click2Protect Plus. Also, it is important to note that term of the policy is limited to 20 years. If a young individual buys Click2Invest plan at the age of 30, life cover will cease at his age of 50. One may find it difficult to buy fresh life insurance policy after that due to advanced age . Even if it could be possible to buy life insurance at that age, policyholder will have to bear higher premium.

Affordability is another question

Everyone goes through ups and downs in life. One may be able to afford a high premium at the current moment but situation may be different ten years down the line. If for some reason a policyholder is unable to pay the premium the policy ceases to be in force. There are better chances that the policyholder can afford to continue low premium term insurance policy throughout it’s term.

Policyholder bears the cost

Even if the policyholder wants to surrender the policy due to underperformance of the underlying fund that is only possible after five years from the date of inception. What maximum the policyholder can do is, to discontinue paying future premiums but in that case the accumulated fund under the policy is moved to the discontinued policy fund. Returns are guaranteed at minimum 4% per annum in discontinuation fund. In such a situation neither the policyholder will have life cover nor his investment will yield desirable returns. This is a double whammy for the policyholder.

Conclusion

Although Click2Invest is a step in the right direction and has low cost yet, the limitations mentioned above are a deal breaker. There is no merit in buying this policy whether from the viewpoint of insurance, investment or tax benefit. Multiple options are available which offer superior solutions in all three areas. One can buy a term insurance policy for Insurance needs and Equity Linked Saving Scheme (ELSS) for investment and tax savings . However if ULIP’s is your investment of choice Click2Invest is the better than what is currently available.