Everything you want to know about NPS

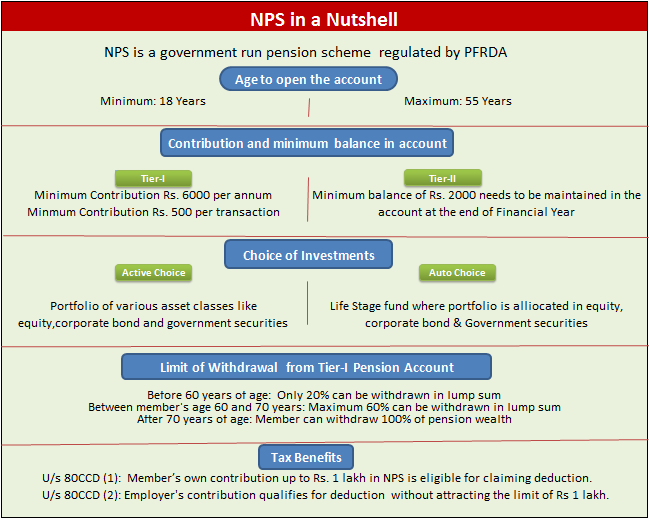

Objective of retirement planning is to accumulate sufficient corpus which can generate regular income after retirement. Unlike most other developing countries, India does not have The Universal Social Security System to protect the elderly against economic deprivation. Hence government introduced a defined contribution based pension system. National Pension System or NPS is a government run pension scheme. The objective of the scheme is to provide old age income to all citizen of India. Any citizen of India, whether resident or Non-Resident between 18-55 years of age can join the NPS. Since retirement planning is a long term goal hence it’s very important to consider safety and returns when planning for retirement.

How to Open the Account

Any person who is interested to join NPS first needs to apply for a Permanent Retirement Account Number (PRAN). As the name suggests this being unique in nature is a permanent number and hence you can use the same number across the country even if you shift your residence. You can enroll into NPS by submit the application at any of the authorized branches of service providers called ‘Points of Presence’ (POPs) along with the Know Your Customer (KYC) and other documents required. There are various banks and broking firms who have been appointed as point of presence where the account can be opened. You have the option to shift from one branch to another branch of a POP at your convenience. Also, one can shift from an existing POP to another POP if required.

Investment Options under NPS

There are two types of accounts Tier 1 pension account and Tier 2 saving account. Tier 2 account is only available for the members who have subscribed to Tier-1. A subscriber has to contribute a minimum of Rs.6000 per year in his Tier-1 account but there is no limit for maximum contribution. A member can contribute up to the age of 60 and the pension will start only after attaining the age of 60 years. Minimum contribution in Tier-II account needs to be Rs. 1000 at the time of account opening and for all subsequent transactions it can be minimum Rs.250. Member must maintain a minimum Account Balance of Rs. 2000 at the end of Financial Year in Tier-II account.

There are two options available to invest under the scheme.

Active Choice:Under active choice you can allocate your investment portfolio among various asset classes like equity, corporate bond and government securities based on your risk appetite but maximum allocation in equity is limited to 50% at any point of time.

Auto choice:This is life stage based fund where 50% of your portfolio is allocated in equity, 30 % in corporate bond & 20% in Government securities between your age of 18-36 years but the exposure in equity and corporate bonds reduces systematically as age increases. Finally exposure in equity and corporate bond is reduced to 10 percent each at your age 55 and balance 80% in allocated in government securities.

You have choice of 8 fund managers to manage your money.

1) HDFC Pension Management Company Ltd.

2) ICICI Prudential Pension Funds Management Company Ltd.

3) Kotak Mahindra Pension Fund Ltd

4) LIC Pension Fund Ltd.

5) Reliance Capital Pension Fund Ltd.

6) SBI Pension Funds Private Ltd.

7) UTI Retirement Solutions Ltd.

8) DSP BlackRock Pension Fund Managers Pvt. Ltd.

Vesting Criteria

Only 20% can be withdrawn in lump sum before 60 years of age and balance 80% pension wealth must be invested to purchase annuity. Between age 60 and 70 years 60% can be withdrawn in lump sum while balance 40% must be invested to purchase annuity. Member can withdraw 100% of pension wealth after 70 years of age. In case of death of the member the nominee has right to withdraw full amount in lump-sum.

Annuities and Annuity Service Providers (ASPs)

1) Life Insurance Corporation of India

2) SBI Life Insurance Co. Ltd.

3) Prudential Life Insurance Co. Ltd.

4) HDFC Standard Life Insurance Co Ltd

5) Bajaj Allianz Life Insurance Co. Ltd. 13

6) Reliance Life Insurance Co. Ltd.

7) Star Union Dai-ichi Life Insurance Co. Ltd.

Charges and Penalty for non-compliance of mandatory minimum contributions

If the subscriber contributes less than Rs. 6,000 in a year n his Tier I account, his account would be frozen and further transactions are allowed till the account is reactivated. In order to reactivate the account, the subscriber would have to pay the minimum contributions, along with penalty of Rs.100 per year of default due for the period of dormancy. A frozen account shall be closed when the account value falls to zero. In Tier II account Penalty of Rs. 100/- to be levied on the subscriber for not maintaining the minimum account balance and/or not making the minimum number of contributions.

Tax benefits

Member’s own contribution up to Rs. 1 lakh in NPS is eligible for claiming deduction under section 80CCD (1) of Income Tax Act. This is within the limit of Rs. 100000 u/s 80 CCE of IT-act that includes section 80C, 80CCC and 80 CCD. The contributions made by your employer towards your NPS account qualifies for deduction under Section 80CCD (2) without attracting the limit of Rs 1 lakh laid down in Section 80 CCE of IT-act. However, there is one restriction that only up to 10% of your salary qualifies for deduction without any monetary limit.

NPS is one of the most suitable products for retirement planning as it offers flexibility to invest in different asset classes. This is a low cost pension scheme compared to the pension schemes offered by life insurance companies. Retirement planning is a long term planning for which safety and returns both are equity important.