Easing Parents’ Financial Burden

India has traditionally been a country where family relationships are given primary importance in the society. Most parents consider it their responsibility to lend a helping hand to their children in their financial requirements, even if their children have a good job and earn a decent income. While some of them may be well off to shell out huge amounts for their children, most parents are often seen struggling to overcome their financial adversities to fund for these expenses only to keep their children happy.

Mr. & Mrs. Ramesh Ganguly, just another couple belonging to the struggling, medium-class population of India, were dealing with the same kind of adversities as their son, Paresh Ganguly, decided to pursue his post-graduation degree in a university abroad. While people in the West become independent and start earning after crossing their teens, in India, the expenses of parents like Mr. and Mrs. Ganguly increase manifold after their children grow up. Some parents continue to fund their children even after their retirement, thus jeopardizing their post retirement plans.

Considering the current difficult economic scenario faced by parents in the country, it is high time for adolescent children to consider lessening the financial burden of their parents by earning, saving and investing for your expenses. It will not only make you a responsible person but will also serve as a relief for your aging parents who can then focus on their retirement plans.

Here are a few tips to ease your parent’s financial burden.

Higher Education Costs Real Money – So Take up an Education Loan

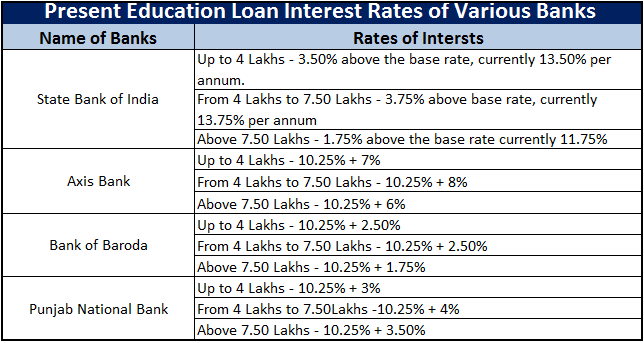

The cost of educating a child has skyrocketed in the last decade. Majority of the parents spend more than Rs 10 Lakhs to provide the basic education for their wards. Considering this, it is not reasonable if you are expecting your parents to fund your higher education expenses as well. In such a case, opting for a loan for your higher education expenses is a better idea. Taking an education loan will instill financial responsibilities and teach you valuable lessons on saving while earning. Most banks, today, provide education loans with interest rates ranging from 11.75% to 18.25% but the good news is that the total interest you pay is fully deductible from gross total income before calculating tax liability for the respective financial year u/s 80 E of IT-act.

Earn and Save to Invest

While it is important to achieve financial independence early in life, what is also important is that you do not misuse your financial independence by blowing up your income. Saving a modest amount every month for your future expenses such as your marriage or for buying your dream home is a great initiative. One can invest in recurring deposits to receive a lump sum amount after a fixed tenure or mutual funds through the low risk SIP route that would allow your money to grow.

If you have sufficient time after your study hours, consider taking up a part time job. You can use the earnings from such jobs not only to supplement your higher education expenses but also as investments to meet your future needs. Also such jobs help you gain work experience and makes you ready to face higher challenges that you face in your profession after completing your education.

Contribute towards Household Expenses

If you are staying with your parents, you can contribute to the household expenses such as home rent, loans and bills. This would provide considerable savings to your parents which they can utilise during their post retirement days. Taking measure such as buying a health insurance for your parents not only provide support for your parent’s healthcare expenses but also provide you with considerable tax deductions from your income. A premium of up to Rs. 15000 ( Rs. 20000 if either of the parents is senior citizen) paid towards health insurance of parents is allowed for claiming deduction from gross total income as per section 80 D of the income tax act.

Reverse Mortgage – An Option

The concept of reverse mortgage is still in its early days in India. In this scheme, the bank pays a senior citizen who is the owner of the house, a fixed monthly income in lieu of him pledging the house. After the death of the owner, the bank provides option to the legal heirs of the property to either repay the loan along with the interest or forfeit the house to be sold by the bank. The balance amount obtained after settling the loan is given back to the heir. This is an ideal earning option for those parents who are asset-rich but cash poor. Be supportive if your parents wish to pursue such measures, since it not only gives them a monthly income but also helps to unlock the value of the property without actually selling it.

Reducing the financial burden of parents goes a long way in helping them lead a stress free and healthy life. Moreover, it will develop you into a responsible individual and will help to set an example for the youngsters around you.