Consider ELSS for tax saving

Sucheta Khatri is banking professional with a considerable experience in the banking domain. Besides that, Sucheta also takes interest in various equity funds and enjoys investing, keeping in mind the market conditions. She also advises her friends to look at equity funds more objectively and broadly. She thinks equity is not simply an investment that gets capital appreciation but also a great way for her tax planning. After all, tax saving is quite significant in the course of financial planning.

One of the quite popular investment schemes for claiming deduction U/s 80 C of IT Act is tax saving mutual fund or Equity Linked Savings Scheme (ELSS). Let’s try and understand ELSS better.

What is ELSS?

An ELSS is a diversified equity mutual fund scheme that predominantly invests in equity shares. Being equity oriented scheme it has potential to generate higher returns compared to other eligible Tax saving schemes in this category. Investment in ELSS has a lock-in of three years from the date of investment. So, in case, one starts with a SIP in an ELSS, the each instalment will get locked for three years from the date of investment. However, if one invests in lump-sum then he can redeem all units after a period of three years.

Just like most equity funds, ELSS too offer both dividend and growth option. Under growth option investor can redeem all units at prevailing NAV only at the end of three years and get a lump sum. On the other hand, investor may enjoy dividend whenever declared by the company, even within the lock-in period if he choose to invest in dividend option.

Investment up to Rs. 1 lakh in ELSS qualifies for claiming deduction from gross total income U/s 80 C of income tax act. Dividend distributed by the scheme is tax free in the hand on investor. Redemption proceeds from the scheme is also tax free, as investment in equity mutual fund for more than 1 year is considered as Long Term Capital asset and any gain on transfer of such Long Term Capital Gain is exempted from tax under prevailing tax rules.

Types of ELSS Schemes by their structure:

There can be two types of scheme

Open Ended: Open ended schemesare open for subscription throughout the year and investor can purchase the units at any point of time. Investor should keep in mind that there is lock-in of three years in ELSS and hence they cannot redeem units before completion of three year from the date of investment despite of it being an open ended scheme.

Closed-Ended: Closed-ended schemes are open for subscription only during New Fund Offer (NFO) and additional units cannot be allotted to the investors after closing of NFO. Maturity period in such closed-ended ELSS may vary from three years to ten years. After the maturity of the scheme mutual fund can redeem all units and pay the proceeds to the investors or may convert the scheme in open-ended scheme.

Options under ELSS

1. Growth Option:Like mentioned earlier, the investor does not get any income in the form of dividend from the fund but can redeem all units only after end of lock-in period. The advantage is the good amount of capital that the investor receives in lump-sum.

2. Dividend Option:Under Dividend option mutual fund may declare dividend based on the performance of the scheme.

Further there may be two sub-options available to investors:

(a) Dividend Payout Options

(b) Dividend Re-investment Options

a) Dividend Payout Options:Dividend Payout Options are generally the exact opposite of the aforesaid discussed growth options. The investors can enjoy liquidity in the form of dividend but the same is unpredictable. However, the main downside of these types of options is that investor cannot expect much capital appreciation at the time of redemption if dividend has been paid regularly.

b) Dividend Re-investment Option:Here, the amount of dividend is reinvested in the scheme automatically as and when declared and additional units are allotted to the investor at prevailing NAV. One caution for this option, however, is that the reinvested dividends do not qualify for claiming deduction from gross total income but get locked for three year from such date. Keeping this in mind investors should avoid dividend re-investment option especially under ELSS, and go for either Growth or Dividend Pay-out.

Things to Look for in ELSS

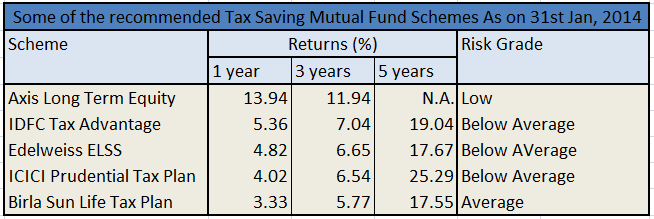

Before investing, it is highly recommended that a proper analysis of the scheme should be done and focus should be on risk adjusted returns and not merely the historical returns. Investment must be made keeping in mind the long term performance of the fund. Of course if you entrust a fund manager, you may also be interested in knowing about his/her approach towards investment, the fund portfolio, the fund expense ratio and the stability of the fund.

Upsides and Downsides of ELSS compared to other Tax Saving Instruments

When one compares the ELSS to conventional tax saving instruments like Public Provident Fund (PPF), National Savings Scheme (NSC) and Bank FDs, one finds that the lock-in period for ELSS is much lesser. A three year lock in period is quite a good deal when compared to a period of 15 years for PPF, 5 or 10 years for NSC, or Bank FDs for 5 years, where the deposits for tax deduction are locked in for relatively more number of years.

Moreover, investment in the equity market via ELSS may give you much higher returns as compared to other asset classes in long term. In fact, even investing through SIP is a good option, owing to the discipline of regular investing.

On the flipside, like any other equity investments ELSS is subject to market risks. All risks associated with equity investments relate to ELSS directly. So, for investors who do not wish to undertake this risk, ELSS could be avoided as an investment option.

Over a long term, ELSS may be one of the best tax saving instruments for investors who are ready to take little risk with their investment for better returns in long term.