Cashless medical payments are possible now with ICICI Prudential Savings Fund

Investors are often advised to keep their contingency cash in liquid funds. Contingency cash primarily comes in handy during financial emergencies such as hospitalisation. Liquid funds have an edge over short-term fixed deposits as the former give better returns to investors. It is also tax-friendly for investors to keep their cash in liquid funds as compared to bank deposits.

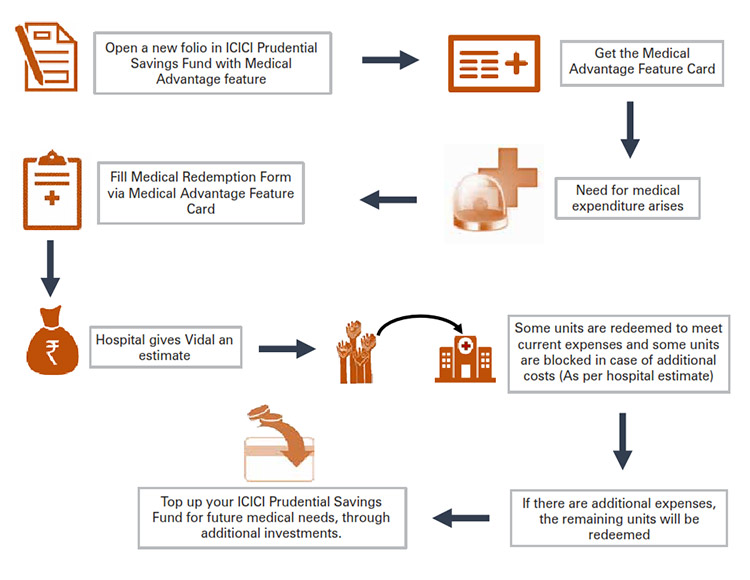

ICICI Prudential Mutual Fund has added medical advantage features to an ultra-short term fund in collaboration with Vidal Healthcare Services, which also comes with a medical advantage. The investor can use the funds from this liquid fund to meet their hospital expenses.

Let’s understand this with an example. In the event of hospitalisation, you can use the Vidal Healthcare card on admission and sign a redemption form. Just like any other mediclaim policy, the third-party administrator (TPA) will take an estimate from the hospital and redeem the units for payment. Based on the hospital’s estimate, even the fund house blocks additional units to buffer in any additional medical expenses. From the investor’s perspective this investment works like a cashless product.

The product comes with several advantages.

1) Get up to 25% discount on hospitalization

2) Easy access to your investments to meet hospitalization expenses at any time

3) Avoid redemption hassles during emergency situations

4) You can avail 24X7 access to a doctor on phone

5) Access to a neutral second opinion and advice on which hospital to choose.

However, you need to pay attention to some terms and conditions:

1) You can use the cashless facility only at 6000 hospitals in 800 cities and 1500 diagnostic centres those are empanelled with Vidal Healthcare.

2) Only investors can use the cashless facility. It cannot be extended to any family member. However, in such a scenario, you can still redeem the units through the normal route.

Should you buy?

This product can act as a top up to your existing mediclaim policy. Medical expenses have been rising over the years. According to Tower Perrin Survey, medical inflation has been moving in the range of 11-13% even as the CPI inflation has fallen from 12% to 6%. Hence your mediclaim cover can fall short of your hospitalisation expenses.

This product can also come in handy for senior citizens. Most senior citizens are unable to expand the sum assured of their mediclaim policies or are unable to buy a new cover. Their age and exclusion of pre-existing medical conditions either make it exorbitant or impossible to buy a health cover. In such a situation, a senior citizen can use the proceeds from this fund to meet their hospitalisation expenses.